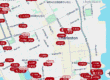

Denver Colorado Stats, Trends & Facts for 2025

- Approximately 50,000 people are considering moving to Denver in 2025

- Active listings in Denver are up 65% from last year

- The median price of a single-family home sold in Denver is still up 5.6%

- January 2025 records show 46% more available homes than January 2024

- Denver inventory doubles 71% year-over-year

- Average 30-year interest rates in Denver at 5.74%

- At 0.49%, Colorado has one of the lowest real estate tax rates in the U.S.

- First-time buyers make up 24% of the market share

- 15% down payment is becoming more common in Denver

Why is Denver a popular relocation destination?

Denver, Colorado, boasts a wealth of adventure in natural beauty, a thriving economy, an active cultural scene, and numerous job opportunities, The city is celebrated as the “mile high” city and is known for its proximity to the Rocky Mountains, which provide unlimited outdoor activity options, making it a highly popular relocation choice for individuals and families in 2025. In fact, approximately 50,000 people are contemplating moving to there in 2025. It has maintained a positive inflow that has kept average price increases reasonable and affordable.

What is the real estate market like in Denver?

A 65% increase in active listings in the metro area offers potential home-buyers greater flexibility and more options within the market. This significant growth in inventory reduces competition and expands opportunities to find the right property. A wider selection prompts sellers to offer more competitive pricing or be more willing to negotiate prices, which benefits buyers throughout the purchasing process. Whether homebuyers are in the market for a single-family home or a condo, this market enables individuals and families to purchase a unique home that meets their needs.

What is the average home price?

With the growing stability of the real estate market, the average price of single-family homes being sold is up 5.6%. As of earlier in 2025, the average price sits at about $580,000, which is comparable to the national average. The increasing population, coupled with a rise in new housing listings, has introduced an expanding housing market with greater inventory and increased affordability. Many buyers are benefiting from this stability and are focused towards purchasing homes that meet their unique needs and show potential for future appreciation. As more people make the move to Denver, property values are expected to continually climb, making now a more appealing time to buy.

How many homes are on the market?

Denver’s growing appeal helps sustain the housing market which remains in balance. A January 2025 report indicates 46% more homes are for sale in the area than in the previous January. This increase in the housing inventory discourages aggressive bidding wars and creates more opportunities for buyers. Amongst polls, buyers say the most difficult step in the home-buying process is finding the right home to purchase; however, this market addresses this challenge by providing a multitude of housing options for potential buyers. Additionally, local real estate agents provide personal guidance and in-depth tours of properties and neighborhoods to help navigate buyer’s choices.

How often are new listings available?

The real estate inventory has shown a 71% increase year over year. Homes are typically listed for three months and, on average, remain on the market for 52 days, with an additional average closing time of 35 days. This time frame provides flexibility and allows buyers to attend open houses, tour multiple properties and compare properties before making a choice. Sellers benefit by stronger offers produced by increased buyer activity.

Andrew Draayer of Andrew The Homebuyer

What is the average interest rate in Denver?

One of the primary factors influencing the Colorado housing market right now is interest rates. As the average 30-year rate is 5.74%, Buyers are no longer battling interest rates in today’s market, as Colorado’s interest rates are significantly lower than pre-2008 averages. This stable environment encourages buyers by keeping mortgages manageable. Local lenders report a more balanced market and share one common trend among Denver cash home buyers is to negotiate seller credits to lower costs further.

What is the average real-estate tax rate?

The world of real estate can be complex, especially when it comes to understanding the tax responsibilities associated with buying properties. With many state taxes reaching above the national average, Colorado residents benefit from one of the lowest real estate tax rates in the U.S, which promotes a positive ownership experience for residents. At 0.49%, Colorado ensures that residents are not burdened by real estate taxes. This advantage solidifies homeownership opportunities, especially for first-time buyers and families who are seeking long-term residence. Lower property taxes allow homeowners to budget more towards home improvements or other financial goals.

What’s the percentage of first-time buyers in?

Buying your first home can be exciting and complex, as 24% of the real estate market, first-time buyers are increasing in Denver communities. This community offers programs and resources, like, local workshops, webinars, and seminars, which are increasingly popular, and aim to educate buyers on mortgages, down payments, and every step of purchasing a home. Furthermore, first-time buyers can qualify for Colorado’s first-time home buyer programs that help them purchase their first home.

How much do you need for a down payment?

While some loan types and local programs allow for lower down payment amounts, down payments can range from 0% to 100% of the total house price, depending on individual factors. Historically, experts have recommended budgeting for a 20% down payment; in modern times, however, a 15% down payment has become more common. With an affordable housing strategy that offers down payment and closing cost assistance to qualifying households purchasing a home in the Denver community, homeownership is becoming more attainable for residents.

Andrew The Home Buyer We Buy Houses For Cash Logo