Charleston Real Estate Trends 2025

The historic city of Charleston, South Carolina, is also the state’s most populous, which means that the real estate market is often dynamic as people buy and sell properties. Knowing the latest trends helps property owners and investors gain a full picture and make more informed decisions regarding their transactions. Below, we’ve shared the latest trends to give you some insight.

- Charleston Homes Cost $584,661 in 2025

- Properties Sold for 2.27% Below Listing Price

- Homes Are Taking 52 Days to Sell on Average

- Interest Rates Are Stabilizing at 6 – 6.5% for Buyers

- There Were 217 New Listings for Single-Detached Homes

- 11.4% Homes Were Sold Above List Price

- 71% of Homebuyers Hope to Stay in the Metropolitan Area

- It Saw 131 Foreclosure Filings Year-to-date

- Selling a Property Costs 12.13% of the Total Sales Price

1. Homes Cost $584,661 in 2025

Per the latest statistics, properties cost $584,661 on average, which represents a 0.6% increase compared to the same period last year. The exact value is expected to plateau in the last quarter of 2025, but the trends consistently show a steady rise since 2023. The number is high above the national average, indicating the rising property prices in the city. If you’re a seller, putting your home on the market may be a good move.

2. Properties Sold for 2.27% Below Listing Price

In August 2025, properties were sold at 2.27% below the listing price on average, indicating that it is currently a buyer’s market. There are more properties for sale than there is demand. However, given the increased property values, homeowners aren’t facing as much of a loss. The market may result in shifts in demand, resulting in a balanced or even seller’s market in the next quarter or year.

Charleston South Carolina

3. Homes Are Taking 52 Days to Sell on Average

Properties are also taking a lot longer to sell, with properties that are staying on the market for an average of 52 days per the latest statistics. Several factors have led to this number, such as property owners overvaluing properties and buyers being more realistic about what they can spend, given the affordability concerns and rising mortgage rates. This trend supports the shift to a buyer’s market, where sellers may have the need to adjust their pricing expectations to attract serious buyers.

4. Interest Rates Are Stabilizing at 6 – 6.5% for Buyers

Compared to the drastic fluctuations brought about by the pandemic, interest rates in South Carolina have become more stable, hovering between 6% and 6.5% for 30-year mortgages. The numbers are still higher compared to pre-pandemic levels, but they are expected to remain stable until the end of 2025. This predictability creates ideal environments for buyers, who are more willing to commit to avoid possible fluctuations in the future.

5. There Were 217 New Listings for Single-Detached Homes

The area saw 217 new single-detached properties listed for sale for the first half of 2025, which represents a 2.5% growth year to date. This growth is modest, but it still represents a gradual expansion of housing inventory within the city. As such, buyers have more options and more negotiation power. If this growth is sustained, then it may begin seeing lower property prices in the future, especially for suburban communities.

Andrew Draayer of Andrew The Homebuyer

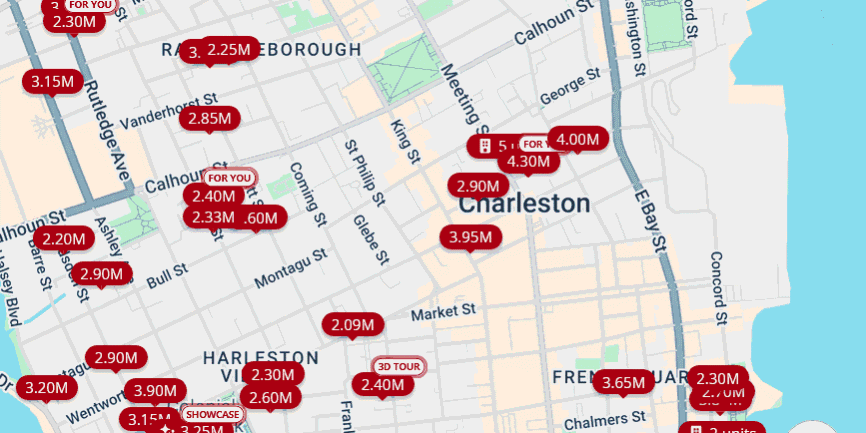

6. 11.4% Homes Were Sold Above List Price

While homes generally sold for 2.27% below the list price, around 11.4% were still sold at a higher value. This data does represent a 0.7% decrease year-over-year, but it’s not as big as the drop in 2022. Sellers still have lots of negotiating power, especially if their property is in high-demand areas like Downtown. Competition remains fierce in desirable properties, resulting in a higher final sales price.

7. 71% of Home Buyers Hope to Stay in the Charleston Metropolitan Area

Around 71% of homebuyers who live in Charleston would prefer to move to a property within the metro area, as opposed to 29% who search elsewhere. This data suggests that the city remains a desirable location. In addition, around 0.41% of national homebuyers searched for information online about moving to Charleston. While the number is low compared to other major cities, this statistic demonstrates that there is still interest from outside the region.

8. Charleston Saw 131 Foreclosure Filings Year-to-date

From the beginning of 2025, around 131 Charleston properties have begun the foreclosure process. The number is still generally low since South Carolina ranks as one of the states with the highest foreclosure rates. However, it may face rising trends if inflation and other economic issues leave people unable to pay their mortgages.

9. Selling a Property Costs 12.13% of the Total Sales Price

In South Carolina as a whole, the cost of selling a property is around 12.13% of the total sales price. This value is above the national average, increasing due to real estate agent commissions, transfer fees, title insurance, and other expenses. For property sellers, understanding the factors that add to the final cost is important for setting expectations. This average can also help you stay aware of hidden or unexpected costs that eat away at your final profit.

Andrew The Home Buyer We Buy Houses For Cash Logo

Wrapping Up: The Latest RE Trends

With the insights shared above, Charleston home buyers, sellers, and investors can gain a better idea of the current market. Various metrics are plateauing, indicating a cooling market. However, it’s still best practice to look at the numbers together to make a truly informed decision about your next step. By considering all these factors together, from migration patterns and foreclosure rates to inventory levels and days on market, you can navigate this new, more balanced landscape with greater confidence.